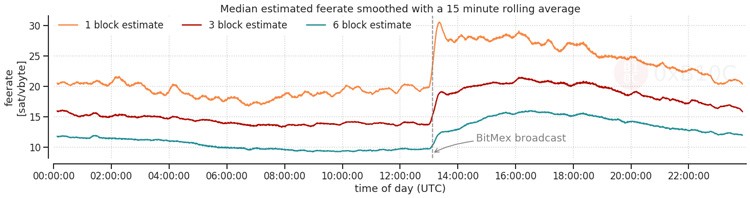

Bitcoin fee rates surge daily at 13:00 UTC, according to a recent analysis by German Bitcoin freelance developer dubbed ‘0Xb10C’.

The respected crypto market researcher has revealed that BitMEX, a leading crypto derivatives platform, is the biggest factor to the fee spike during the afternoon European hours and morning hours in the U.S.

According to the publication, BitMEX broadcasts its transactions and internal UTXO consolidations at around this time creating an oversupply of the number of BTC transactions in the queue within the blockchain.

The analysis which used Bitcoin Transaction Monitor to observe the market since September further notes that this significantly affects the BTC rates for around two hours:

“The fee rates of the newly arriving transactions react to the increased estimates. The average fee rate sharply increases at around 13:00 UTC and continues to rise over the next hours. At about 15:30 UTC, the daily maximum is reached. From there on, the fee rate starts to decrease slowly.”

The Supply Imbalance in BTC Transactions

The crypto market is still a young space with low liquidity compared to traditional markets. It is, therefore, not surprising that one player can create an imbalance large enough to affect the whole market.

The stats by 0Xb10C reveal that BitMEX had broadcasted around 415,000 transactions into the BTC network within the six-month tracking period. This is taken up roughly 2.8% of total bites while paying a total miner fee of 181 BTC. Given these stats, the BTC market fee rates inevitably shift once BitMEX exchange posts its transactions.

This change in transaction cost can be explained by the simple law of demand and supply. Most BTC wallets are designed with fee estimators to inform the trader on the fee rate for the transaction to be processed in a timely fashion.

In the event of overload such as at 13:00 UTC, it becomes more expensive to have the transaction settled which ultimately forces traders to increase their fees for transactions to be given priority within Bitcoin’s network. The analysis on BitMEX further echoes this position:

“The BitMEX broadcast causes an average fee rate increase by 4 sat/vbyte between 13:00 UTC and 21:00 UTC.”

Suggested Solutions

The research offers several solutions to address this market ‘manipulation’ by major entities in the crypto exchange industry.

Most notably are scaling solutions such as SegWit output which is also in the pipeline for implementation by peer competitors like Binance. He also suggested the leveraging of output batching and a Bitcoin upgrade dubbed ‘Schnorr/Taproot’ scheduled to launch next year:

“By utilizing scaling techniques, some of which have been industry standards for multiple years, the impact could be reduced. BitMEX is stepping in the right direction by planning to switch to nested SegWit. They, however, shouldn’t stop there.”