The outbreak of the COVID-19 pandemic combined with the deteriorating financial market is pushing us towards another financial recession. Even the safe-haven assets like government bonds and gold have seen a decline in value. Oil futures product has fallen below zero for the first time in history while the international crude oil price is at its all-time low. Even Bitcoin, which is considered by many as the modern-day digital gold has seen massive price decline similar to other global financial assets.

However, amid this crisis stablecoins which are basically a form of digital currency backed by a stable asset like gold and US Dollar, have found a lot of traction in the market and not just on crypto exchange where it was primarily intended to act as a bridge currency. The main reason behind creating such stablecoins was that it offered some of the better functionalities of decentralized currencies like Bitcoin and Ethereum but without the shortcomings like high volatility.

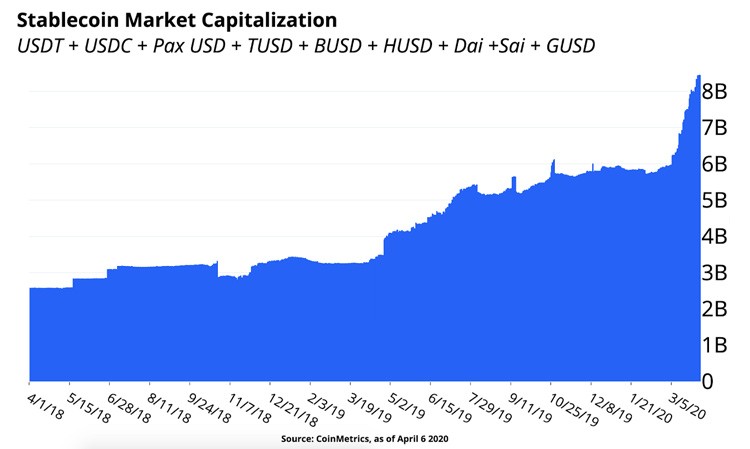

At present, there are 9 stablecoins currently circulating in the crypto space like USDC, USDT, and BUSD. While USDT is certainly the king has a market dominance of over 90%, but then other stablecoins like USDC is also making a mark through exchanges like Coinbase and Circle.

The Stablecoin Ecosystem Grows Amid Volatile Market

As per a recent report from Coinbase, while the majority of the crypto market has seen a decline in the past couple of months, the stablecoin ecosystem has grown by almost $3 billion. As per data from Coinmetrics, the stable coin market cap has grown to $9 billion.

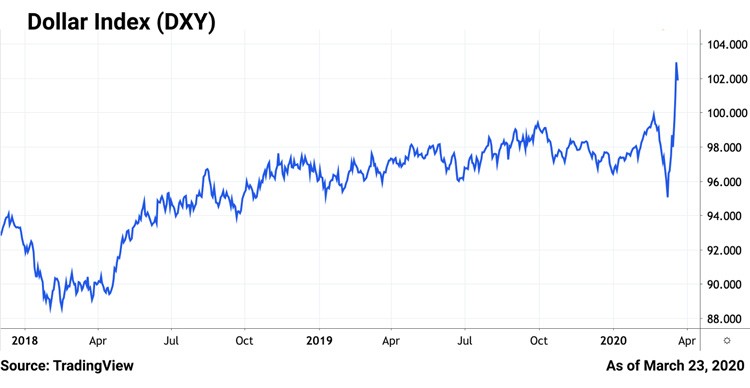

While market volatility is certainly one of the key reasons behind the spike in interest for cryptocurrencies, there is another factor that has emerged during these troubled times. During times of financial crisis, the demand for universal trade currencies like the US Dollar rises significantly. However, despite Feds printing trillions from the past couple of months, it is not able to meet the demand in both the private and international market, as a result, investors turn towards the digital equivalent of these crypto-assets which are stablecoin and are more readily available than the actual USD.

Apart from that these stablecoins are not just the digital equivalent of the USD, but also offer a ton of functionalities like instant transfer, available 24*7, borderless and minimal fees. The Bank of International settlement also recognized the potential and properties that these stable coins possess and noted,

“In principle, retail stablecoins could enable a wide range of payments and serve as a gateway to other financial services. In doing so, they could replicate the role of transaction accounts, which are a stepping stone to broader financial inclusion.”

While USDT is certainly a market leader with over 90% market dominance, its issuance company is embroiled in a number of lawsuits, and USDC another stablecoins seems to have found more traction in these times. The volume of USDC has risen from $457 million to its all-time high of $700 million. The on-chain value transfer using USDC has also reached an all-time high of $400 million.

Decentralized Finance ecosystem which is another Ethereum based pure decentralized ecosystem where people can lend and borrow in stablecoins by hedging Ether. While the DeFi ecosystem makes use of collateral-less stablecoins like DAI which are not backed by any stable asset, rather its value is maintained by the collateralized Ether and the interest rate.

Thus it is quite evident that the recent surge in volume for stablecoins is because of multiple factors including volatile financial markets, the demand for USD in the international market, and its use in financial settlements outside crypto space.