Bitcoin halving is just a week away, which has put the limelight on Bitcoin again, as many are expecting a huge price surge in the aftermath of the Bitcoin block reward halving.

Google data suggests that queries and searches related to halving event have reached an all-time-high thus confirming the high level of curiosity among the common public.

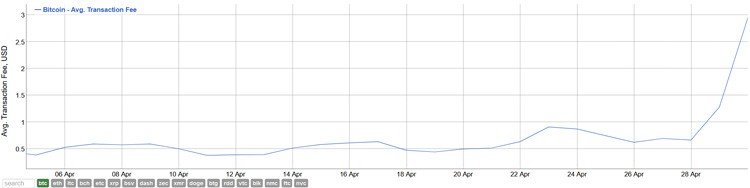

The average cost of a Bitcoin transaction has reached $2.94 which is highest since July 2019 or highest in 10-month just a week before the halving, suggest data from Bitinfocharts.

Many analysts and Bitcoin proponents have advised everyone to buy some Bitcoin before the halving and it seems people are following that advice since the number of non-zero balance wallets has peaked at an all-time high as well.

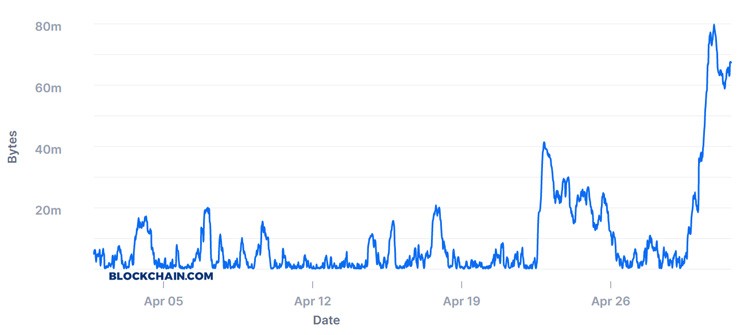

This increased activity on the Bitcoin network has also created congestion which is evident from the high number of unconfirmed transactions in the Bitcoin mempool.

The pending transaction would require hours to clear and users would be required to pay a premium fee to get their transaction confirmed, thus bringing back the scalability issue of the Bitcoin network.

Bitcoin network is not new to these kinds of mempool congestion. Back in 2017 when Bitcoin touched its all-time-high price of near $20k, the mempool was so congested that it took days to confirm transactions and the average Bitcoin transaction fee rose to $55.

Massive Spike in Average Bitcoin Transaction Fee Within 48 hours

The data also suggested that the Bitcoin network saw a massive 129% rise in the average transaction fee within on Thursday night. Just 24 hours prior to that spike the average transaction fee was around $1.28 and $0.66 a day prior to that. The spike in transaction fee was observed throughout April, where these prices rose by 673% from April 1st to April 30.

While increased transaction fees and a congested network does bring back the scalability debate, it is also a sign of high demand. With the continued bear market in the past two years, many have high hopes from Btc and are hoping for a bull run similar to that of 2017.

Bitcoin started the year on a bullish note and crossed the $10k mark in the month of March, rekindling the hopes of a bull run prior to the halving.

However, the black Thursday market crash on March 12th created a sense of panic among investors and many were quick to dismiss bitcoin for the umpteenth time. Bitcoin made a full recovery of its March 12th on April 29th and briefly traded near $9.5k mark reigniting the bullish sentiment.